Why noise, missing data, and hidden risks sabotage your models and how to fix it

You’ve watched backtests shine—only to see real-world trading blow up. The culprit? Unmodeled uncertainty. Market noise, data gaps, and invisible distribution quirks turn robust strategies into fragile house of cards.

In this chapter you’ll get the battle-tested toolkit to transform chaos into edge.

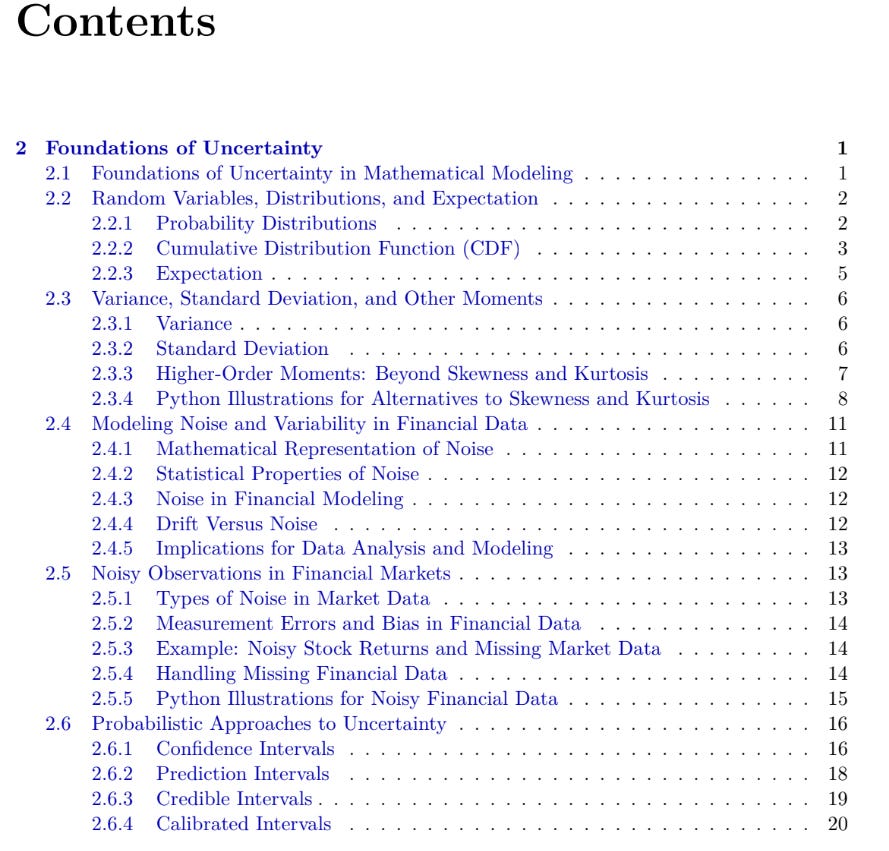

What’s inside:

🔹 The anatomy of financial noise: Decode microstructure effects, biases, and outliers—and why Gaussian assumptions fail.

🔹 Beyond mean-variance: Edgeworth expansions, L-moments, and spectral tools to capture hidden tail risks and nonlinear dependencies.

🔹 Data disasters solved: Python-powered fixes for missing data, measurement errors, and biased feeds (no more "garbage in, gospel out").

🔹 Uncertainty quantified: Confidence vs. prediction vs. credible intervals—and why conformal prediction is a game-changer for live trading.

🔹 Trading-ready Python: Simulate noisy markets, clean dirty data, and deploy probabilistic risk controls with 7 ready-to-run scripts.

This isn’t academic theory. It’s your survival kit for trading in a world where "unknown unknowns" are the only certainty.