[Intel Report] Volatility returns

Not just politics—now it’s about icons, margins, and American-made pressure.

Table of contents.

Introduction.

Sector-specific risks.

Apple and the tech sector.

Tariffs and the yield curve.

Investor strategies and watchpoints.

Introduction

In late May 2025, former U.S. President Donald Trump jolted global markets with a barrage of protectionist threats on Truth Social. He proposed a 50% tariff on all goods imported from the European Union effective June 1, 2025, unless those goods are manufactured in the United States, and separately warned that Apple’s iPhones would face a 25% tariff if not produced domestically. These unprecedented tariff rates—essentially a trade-war “nuke”—immediately set off shockwaves across equities, bonds, and commodities. Investors are now grappling with the financial fallout and trying to gauge the broader macroeconomic consequences. Do you remember it?

Well, things have changed:

The tariff threats triggered a swift sell-off in global equities. On Wall Street, major indices fell sharply on the news and ended the week in the red. The S&P 500 dropped about 0.7% on Friday—with tech-heavy Nasdaq down 1%—capping a weekly loss of over 2.5%. The Dow Jones also shed ~0.6% that day. In Europe, stocks fared no better: the pan-European STOXX 600 slumped 0.9%—its worst one-day drop since early April—and Germany’s export-sensitive DAX index plunged 1.5% from near record highs. Other key EU markets like France’s CAC 40 and Italy’s FTSE MIB fell over 1%. Traders clearly interpreted Trump’s move as reopening a major front in the trade war, and “Here we go again!” seemed to be the prevailing sentiment.

Unsurprisingly, fear gauges spiked. In the U.S., the VIX jumped roughly 10%, hitting its highest level in over two weeks. Europe’s volatility index—V2TX—likewise surged to a 3+ week high amid the turmoil. This reflects investors scrambling for protection as uncertainty around trade policy returned with a vengeance. Safe-haven flows into options and hedging instruments picked up, anticipating choppy sessions ahead.

Bond markets flashed classic risk-off signals. Investors piled into government bonds, sending yields lower across the curve. The benchmark U.S. 10-year Treasury yield, which had been at multi-month highs, fell about 4–5 basis points to ~4.51% on the news. Shorter-term yields like the 2-year also eased as markets began pricing in potential economic weakness and future rate cuts. Even longer-dated 20-year bonds rallied, pulling yields down. In Europe, benchmark 10-year government yields dropped in tandem with U.S. Treasuries. This plunge in yields signals that investors sought refuge in bonds, expecting that a full-blown trade war could hurt growth and eventually force central banks to loosen policy. Notably, eurozone bond traders boosted bets on ECB rate cuts, now expecting deeper easing by year-end—the expected ECB deposit rate for December fell from 1.72% to 1.60% in a single day. Taken together, the market moves – slumping stocks, spiking VIX, and sliding yields – underscore how seriously investors took Trump’s tariff salvo and the looming risk of an EU-U.S. trade rupture.

Sector-specific risks

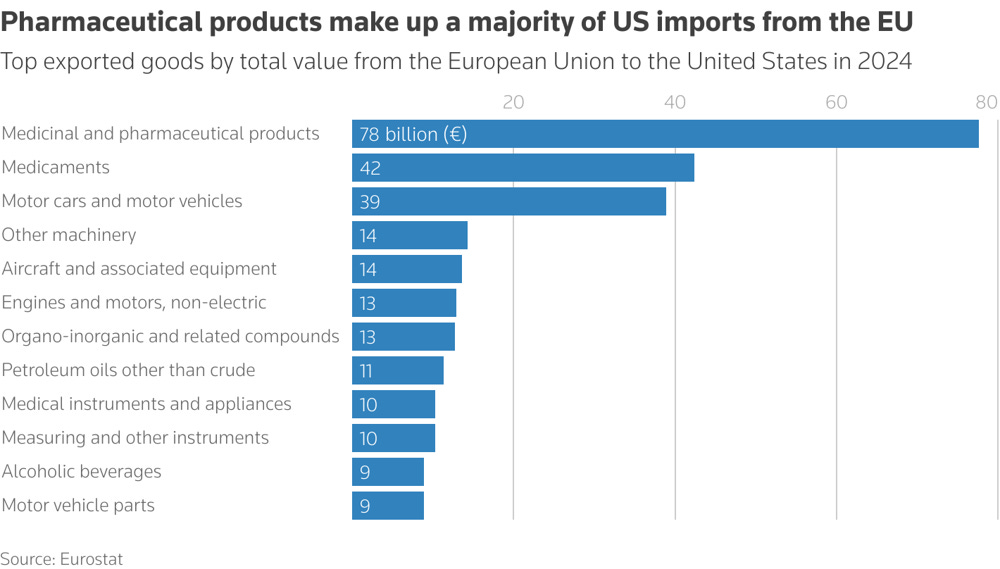

Trump’s proposed 50% blanket tariff on EU goods casts a wide shadow, but certain industries are disproportionately exposed due to their heavy reliance on U.S. sales. Chief among them are European pharmaceuticals, automobiles, and industrial machinery/aerospace – sectors that form the backbone of the EU export machine. Markets immediately recognized this: on the announcement day, Europe’s STOXX autos & parts index plummeted 3.1%, and even the luxury goods index—home to export-reliant brands—fell 2.7%.

The risks for each key sector:

Pharmaceuticals: Medicines are Europe’s single largest export category to the U.S., totaling roughly €120 billion in 2024. This includes drugs and medicinal products from companies like Roche, Bayer, Novartis, and Novo Nordisk. Notably, pharmaceuticals had been spared in earlier tariff rounds during Trump’s trade disputes—perhaps due to concerns over patient access and lack of local substitutes. This time, however, it’s unclear if the industry will remain shielded. A 50% tariff would dramatically raise the cost of European-made drugs in the U.S., potentially slashing demand or forcing European pharma firms to absorb huge cost hits. Profit margins and U.S. market share for flagship drugs could suffer. Pharma executives are alarmed that pricing power may erode if tariffs hit–U.S. insurers and buyers might push back on higher costs, and some production might need to relocate to avoid duties. In sum, a formerly insulated sector now faces the risk of being drawn into the trade war crossfire.