Why probability isn’t what you learned in school—and why it matters for your trades

You’ve seen trading strategies collapse when markets go haywire. You’ve watched "robust" models fail during crashes. The culprit? Misunderstanding financial uncertainty.

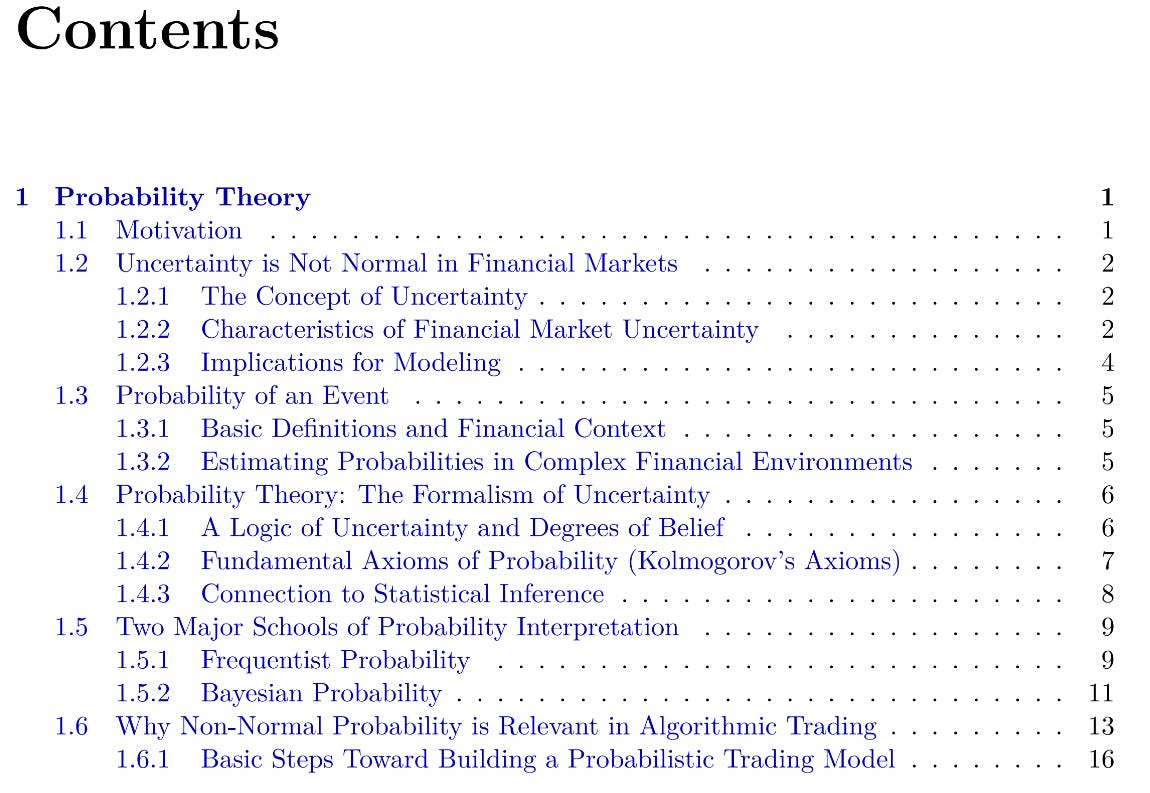

In this chapter you’ll discover why textbook probability fails in real markets—and how to fix it.

What you’ll learn:

🔹 Why "normal" distributions lie to you (fat tails, skewness, and volatility clustering aren’t anomalies—they’re the rule).

🔹 Critical flaws in historical data that silently sabotage your risk models.

🔹 Frequentist vs. Bayesian approaches adapted for finance—no ivory-tower theory, just actionable insights.

🔹 Python-ready techniques to model extreme events, quantify tail risk, and build resilient strategies.

This isn’t abstract math. It’s a survival manual for trading in markets where uncertainty is violent, asymmetric, and wildly non-normal.